Advertising

Categories

Tags

-

#Virtual Networking Market

#Virtual Networking Market Research

#Virtual Networking Market Trends

#Virtual Networking Market Growth

#Virtual Networking Impact Covid-19 analysis

#Virtual Networking Market Future

#Virtual Networking Market Forecast

#Virtual Networking Market Analysis.

#Railway Cybersecurity Market

#Railway Cybersecurity Market Research

#Railway Cybersecurity Market Trends

#Railway Cybersecurity Market Growth

#Railway Cybersecurity Impact Covid-19 analysis

#Railway Cybersecurity Market Future

#Railway Cybersecurity Market Forecast

#Railway Cybersecurity Market Analysis.

#Management Consulting Market

#Management Consulting Market Research

#Management Consulting Market Trends

#Management Consulting Market Growth

#Management Consulting Impact Covid-19 analysis

#Management Consulting Market Future

#Management Consulting Market Forecast

#Management Consulting Market Analysis.

#Power Device Analyzer Market

#Power Device Analyzer Market Research

#Power Device Analyzer Market Trends

#Power Device Analyzer Market Growth

#Power Device Analyzer Impact Covid-19 analysis

#Power Device Analyzer Market Future

#Power Device Analyzer Market Forecast

#Power Device Analyzer Market Analysis.

#Process Orchestration Market

#Process Orchestration Market Research

#Process Orchestration Market Trends

#Process Orchestration Market Growth

#Process Orchestration Impact Covid-19 analysis

#Process Orchestration Market Future

#Process Orchestration Market Forecast

#Process Orchestration Market Analysis.

#Top Drive Systems Market

#Top Drive Systems Market Research

#Top Drive Systems Market Trends

#Top Drive Systems Market Growth

#Top Drive Systems Impact Covid-19 analysis

#Top Drive Systems Market Future

#Top Drive Systems Market Forecast

#Top Drive Systems Market Analysis.

#Tax Management Market

#Tax Management Market Research

#Tax Management Market Trends

#Tax Management Market Growth

#Tax Management Impact Covid-19 analysis

#Tax Management Market Future

#Tax Management Market Forecast

#Tax Management Market Analysis.

#UV light Stabilizers Market

#UV light Stabilizers Market Research

#UV light Stabilizers Market Trends

#UV light Stabilizers Market Growth

#UV light Stabilizers Impact Covid-19 analysis

#UV light Stabilizers Market Future

#UV light Stabilizers Market Forecast

#UV light Stabilizers Market Analysis.

#Film Capacitor Market

#Film Capacitor Market Research

#Film Capacitor Market Trends

#Film Capacitor Market Growth

#Film Capacitor Impact Covid-19 analysis

#Film Capacitor Market Future

#Film Capacitor Market Forecast

#Film Capacitor Market Analysis.

#Submarine Sensor Market

#Submarine Sensor Market Research

#Submarine Sensor Market Trends

#Submarine Sensor Market Growth

#Submarine Sensor Impact Covid-19 analysis

#Submarine Sensor Market Future

#Submarine Sensor Market Forecast

#Submarine Sensor Market Analysis.

Archives

Tax Management Market | Trends, Statistics, Dynamics and Segmen

-

Posted by mayuri kathade - Filed in Business - #Tax Management Market #Tax Management Market Research #Tax Management Market Trends #Tax Management Market Growth #Tax Management Impact Covid-19 analysis #Tax Management Market Future #Tax Management Market Forecast #Tax Management Market Analysis. - 99 views

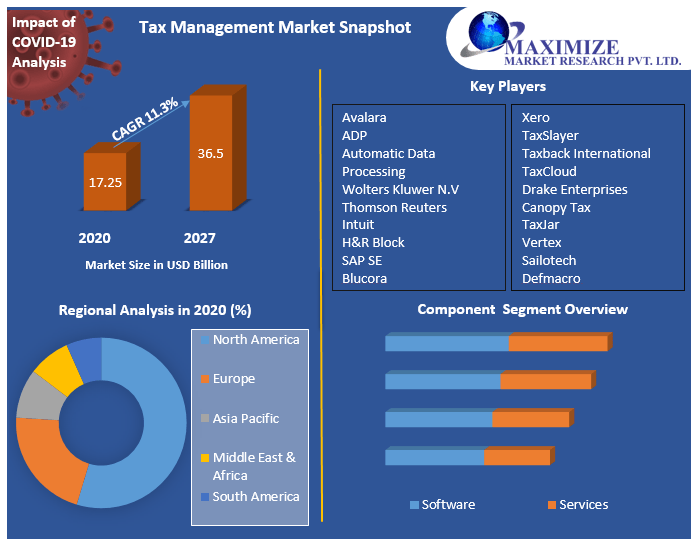

Tax Management Market Overview:

This report discusses the market growth drivers and obstacles for the manufacturer, as well as a review of the significant trends in the market's business strategies, procedures, and financially sound and expand approach. Customization is also possible to meet the needs of individual customers, as well as a complete understanding of market potential. The Tax Management Market provides a comprehensive overview of the market's competitive landscape and main merchants. This report can assist with structural planning in light of current industry conditions.

Request for free sample: https://www.maximizemarketresearch.com/request-sample/116778

Market Scope:

According to the forecast period 2021-2027, the Tax Management market is expected to grow at a steady rate of xx % between 2021 and 2027. The market is estimated to increase in the forecast period of 2021, as key industry players continue to complete projects.

This report includes a value-based analysis and forecast for the Tax Management market. This study and analysis of market drivers, constraints, and opportunities impacting the growth of the Tax Management Market is included in this report. Tax Management Market segmentation has been provided based on type, source, end-user, and geography (country-wise). The scope of the study included a strategic analysis of the Tax Management market in terms of individual growth trends, future prospects, and the contributions of key sub-market stakeholders. Tax Management Global market analysis and forecasts for five key regions: North America, Europe, Asia Pacific, the Middle East and Africa (MEA), and Latin America, as well as country-by-country segmentation. The profiles of main industry participants, as well as their strategic perspectives, market positioning, and analyses of core competencies, are included. The top companies participating in the Tax Management Market are also profiled in terms of their competitive advancements, investments, strategic expansion, and competitive landscape.

Tax Management Market Segmentation:

On the basis of component, the global tax management market is sub-segmented into Software, Services.

The software segment held the largest share of xx% in 2020. Tax management software makes it easier for businesses of all sizes to complete their tax filings. The programme ensures that tax compliance with local accounting laws and standards is automated. To keep up with quickly changing legislative restrictions and fluctuations in product taxability, businesses all over the world have begun to implement tax administration software.

The service segment is expected to grow at high CAGR of xx% during the forecasting period of 2020-2027, owing to rising need for services related to tax management software like installation, support, maintenance training, and others.

Get more Report Details : https://www.maximizemarketresearch.com/market-report/global-tax-management-market/116778/

Tax Management Market Key Players:

- Avalara

- ADP

- Automatic Data Processing

- Wolters Kluwer N.V

- Thomson Reuters

- Intuit

- H&R Block

- SAP SE

- Blucora

- Sovos Compliance

- Vertex

- Sailotech

- Defmacro Software

- DAVO Technologies

- Xero

- TaxSlayer

- Taxback International

- TaxCloud

- Drake Enterprises

- Canopy Tax

- TaxJar

Regional Analysis:

The Tax Management market is organized into five regions: Europe, North America, Asia-Pacific, the Middle East and Africa, and Latin America.

COVID-19 Impact Analysis on Tax Management Market:

The globe has reached the end of the COVID-19 pandemic's recovery phase. In light of the current economic scenario, Maximize Industry Research has launched the Tax Management Market Status, Trends, and COVID-19 Impact Report 2021, which provides a comprehensive look at the Tax Management market.

Key Questions answered in the Tax Management Market Report are:

- Which product segment grabbed the largest share in the Tax Management market?

- How is the competitive scenario of the Tax Management market?

- Which are the key factors aiding the Tax Management market growth?

- Which region holds the maximum share in the Tax Management market?

- What will be the CAGR of the Tax Management market during the forecast period?

- Which application segment emerged as the leading segment in the Tax Management market?

- Which are the prominent players in the Tax Management market?

- What key trends are likely to emerge in the Tax Management market in the coming years?

- What will be the Tax Management market size by 2027?

- Which company held the largest share in the Tax Management market?

Contact Us:

MAXIMIZE MARKET RESEARCH PVT. LTD.

3rd Floor, Navale IT Park Phase 2,

Pune Bangalore Highway,

Narhe, Pune, Maharashtra 411041, India.

Email: sales@maximizemarketresearch.com

Phone No.: +91 20 6630 3320

Website: www.maximizemarketresearch.com

More Related Link : http://www.marketwatch.com/story/mexico-online-on-demand-home-services-market-business-function-deployment-mode-organization-size-industry-vertical-forecast-2026-2022-01-14